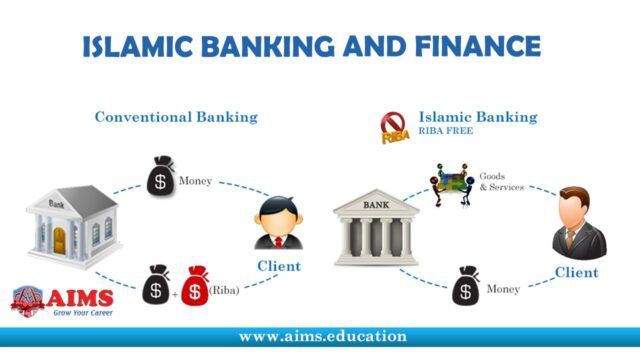

Introduction to Islamic Banking

The most prominent feature of the Islamic economic system is the prohibition of interest. Islamic economic policies have been applied exclusively in the financial industry, especially in banking. Islamic finance is growing at multiple levels and is now spreading to other financial sectors such as insurance, structural financing, project financing, mutual funds, syndicated finance, investment banking, etc. At the geographical level too, Islamic banking has grown from the Middle East to Europe and now has a good position in the South Asian market as well.

Shariah compliance also ensures corporate social responsibility (CSR) and ethical compliance. Islami Bank does not conduct business with companies involved in tobacco, alcohol production or gambling, casinos, nightclubs, prostitution, etc. This system has given the name of ‘Ethical Banking’ to Islamic banking in Europe.

The balance sheets of Islamic banks are capable of taking a financial push. Islamic banks are not obliged to pay fixed returns to their depositors and general creditors. Creditors, shareholders, and depositors share and participate in the business of the bank. Therefore, if there is a push towards assets (NPL increase), diploma in Islamic banking will be able to share this loss with their depositors and shareholders.

Financing activities of Islami Bank

The following methods are used in Islamic banking for making payments.

Reducing Musharakah

In the declining Musharaka, the customer goes to the bank for joint purchase of an asset/property. This is called ‘Diminishing Musharakah’ because the tenant’s ownership increases and the bank’s ownership decreases or decreases with time. If the ownership of the tenant increases, the rent decreases. The bank’s share in assets/property is divided into units. These units are purchased periodically by the customer until he purchases all the units. After purchasing all the units of the customer bank, he becomes the sole owner of the assets/property.

Murabaha Muazzal

Murabaha is a late payment sales transaction. Murabaha is used for working capital financing, SME financing, and trade financing. The process flow of Murabaha is as follows:

Islami Bank and the client signed a Master Murabaha Islamic finance certification Agreement and an Agency Agreement. According to the agency agreement, the customer purchases the product from the supplier on behalf of the bank. The customer promises to purchase assets from the bank. It is a one-sided commitment and commitment. The bank pays the supplier and receives the title and physical/structural possession of the property. The customer signs a declaration that he has purchased the goods on behalf of the bank and is now willing to purchase the assets.

Lease

Leasing means renting something. In a lease, the right to use a property is transferred to another person for consideration. The process flow is as follows:

The customer goes to the bank to get an asset with the lease. The customer is responsible for making periodic lease payments for the lease term. Lease agreements and company agreements are signed. The customer purchases assets as an agent of the bank. The bank receives the title of the asset and pays the seller. The bank leases the assets and the customer starts using the assets and pays the rent for each period. Finally, the customer can purchase assets from the bank through a separate purchase agreement.

Salam

It is used to finance products and services that are not ready for spot sale and need to be delivered later. Hi, payment spot, but delivery is delayed. In current practice, it is used in currency trading as an alternative to the bill of exchange discounting and agricultural financing.

Istisna

It is used to finance products that are not yet ready for sale and need to be made. Examples include tailoring services, architect services, etc. It is the producer’s order to make a specific product for the buyer It is used to finance pre-shipment exports and is useful in all other situations where the product has to be made before the sale.

Read More.. 21 Best Alternatives of Manga Stream to read manga Instantly Best Crazy Games For Childrens How to make selfies with dorian rossini What Happened to Konami The 13 best things to do in the ICELAND 6 Things to Know About Wrongful Death Suits How to increase your customer numbers How to Manipulate Online Slots Know Lab Made Loose Diamonds in Easy Steps 5 Best Winter Fashion Style Tips 5 Best Work From Home tips You should know The 5 Best Budget Friendly Hair Dryers 5 Best Fruit for Babies Diet Methods of Freight Rate Quotes Advantages of Road Freight Understanding Search Engine Optimization in the Competitive Marketplace Tips to Winning Big in Online Casino GPHR Certification Make Your Target Challenges Facing Shippers Transport Top 5 Methods for Online Slots 10 Daily Habits to Keep a House Clean and Tidy Calgary Window Reviews Lux Windows versus Jeld Wen Windows and Doors The Black 411 Announces Plans An Ultimate Guide for CompTIA SK0-005 Exam by Exams4sure List of Few Best Gaming APIs Like Escape from Tarkov, Fortnite API and More How to Get a Used ATV or UTV on the Economical Buying guide for Lighting Reasons Why Regular Website Maintenance Is Important Tips to make your Beauty Beds Last Longer 123Movies Watch Movies Free Online Where to birthday cake order in kohara Finding the Best Freight Shipping Quotes Top 10 Nursing Trends That Will Shape Healthcare Basic Safety Measures For Athletes’ Protection Repair Or Replacement What Does Your Tyre Need VoIP headsets Heads Free Head Set Zone Trending App Ideas for Beginners 8 Reasons to Maintain Up to Date Bookkeeping The best international high schools in Tokyo Japan On Site Rigging Services For The Transportation Industry 5 Ways to Improve Team Communication and Collaboration Why Should You Hire Professional Roofing Contractors in Daytona Beach How To Live A Balanced Lifestyle With Work In Canada Tips to enhance your IGTV Videos Best Furniture For Home in Dubai

Also read about:

Online Casino Gambling & 8211 The Basics of Online Slots

DRAGON222 Online Slots List of Trusted Online Gambling Sites

Why is it that Korean casinos are becoming increasingly popular